If Referrals are Gold, Then Partnerships are Fool's Gold for Early Stage Startups

I recently mentioned that attempting partnerships was one of the 7 tactics I employed to avoid real sales effort while building my proptech startup, and I think that deserves some clarification.

The amount of effort spent on partnerships over the years resulted in a negative ROI for us, but opening up a functional referral channel was quite the opposite.

What I mean by “Partner”

Before we dig in further, let’s define terms.

The word “partner” gets thrown around in business. It’s conflated with referrals much in the same way that “business development” is conflated with sales.

Discerning between a Referral program vs a Partnership strategy comes down to three aspects:

Level of Alignment – How closely both entities’ goals and customer bases align.

Depth of Engagement – The extent to which both parties collaborate beyond just referring customers.

Shared vs. Delegated Delivery of Value – Whether value is created together or simply handed off.

Referrals are a tactical channel that allows simply connects us to a customer through another person’s introduction (or maybe just a click). The depth of relationship from the referring party may vary, but their relationship with the product or service we provide is limited, so it’s not a true “partnership” in the strategic sense. Like Sales, the offering is set and it’s about connecting that offering with more customers through people who can bring it to them. Those people bringing your offering to customers just so happen to be outside your organization.

There’s no bold line when you cross over from Referrals to Partnerships, but the direction you are walking is towards Strategy. In a properly executed partnership, two separate companies who are targeting the same set of customers team up to deliver joint value, somehow. A partnership could include a referral program, and it could even be the centerpiece. But a plan has been built which identifies the assets, value proposition, and delivery mechanism for joint value that neither company could deliver independently. There’s a depth of value delivery beyond an introduction or click. While referral networks are about Width, partnership channels are more about Depth.

There’s a lot that needs to go right for a partnership to be successful. Much more than I realized as a first-time startup founder.

How (not) to nail partnerships as a startup

At various stages building my proptech startup, I sought partnerships with other proptech companies, commercial real estate service providers, and fintech companies outside real estate. Between my own attempts and trading notes with other founders, I’ve found some common failure patterns.

1. Partnerships usually fail at early stages

For many early-stage startups, partnerships can be an excuse not to focus on direct sales. Chasing partnerships can feel like progress—it involves meetings, strategic discussions, and potential big wins—but more often than not, it’s fool’s gold. Partnerships won’t work if product-market fit doesn’t already support organic growth. A startup that isn’t closing direct sales will struggle even more in a partnership model, where complexity and alignment challenges are multiplied.

Startups should first solidify their core offering, gain direct sales traction, and ensure their business is ready before attempting partnerships.

When a startup’s value proposition is still evolving, partnerships are a poor use of time. Startups should first solidify their core offering, get direct sales traction, and ensure their business is ready before attempting partnerships.

2. Partnerships fail if not given proper resources

Partnerships require real investment—dedicated team members, alignment meetings, legal agreements, and some level of product integration. If they’re treated as a “side project,” there will likely come a point where a premature ROI measurement will kill the project, leaving the startup in the equation off in worse shape than when they started based on wasted time and resources.

3. Partnerships fail because of people

If you think customers can be irrational, try partners.

An organization has a set of assets, risks, and priorities. It’s possible to outline all the organizational components that impact a partnership opportunity, and completely strike out anyway, because the people in the organization each have their own perspective, goals, and ego. A misalignment on a personal level can derail partnerships just as well as a misalignment between organizations.

My proptech startup took investment from an angel investor syndicate that was primarily made up of investment sales brokers who all led or worked under the same regional brokerage entity. After striking out on a couple of proptech partnerships we had hoped to achieve, this seemed like the perfect opportunity. Investment sales brokers (professionals who market and sell commercial buildings) were selling a different service to the same crowd, and they were one step ahead of us in the transaction sequence, facilitating the successful matchmaking of buyer and seller (the buyer would then need to arrange financing for the building purchase). Other investment sales brokers were already part of our referral network, so we had a strong signal that a more integrated partnership was a worthwhile investment.

Not only did we fail to scale a partnership with that group, we never made any revenue with that group. They had invested in our venture, served the same customers, and we never even launched a pilot. The reasons for this failure to launch were entirely people-driven—despite our two organizations being theoretically 100% aligned.

That said, not all of our partnerships were failures. We did manage to build a couple of small-scale successes where a partnership led to some revenue, even if they did not evolve into major growth drivers. These were typically simpler arrangements where expectations, incentives, and alignment were clearer from the start. However, these exceptions were rare, and they didn’t change the overall reality that partnerships were not the growth lever we had initially hoped for.

4. Partner explorations may have other unintended consequences

Coming home with zero value after investing time and energy into a partnership is a bad outcome—but it’s not the worst.

In the early days, another founder made an introduction to a proptech company playing in a similar space to ours. They asked a lot of questions about our direction, took detailed notes, and then… pivoted to compete with us directly. While we ultimately beat that particular competitor, we could have been in real trouble.

Some companies will field partnership discussions purely as a means to gather intelligence on your business. This is one of the rare areas of startup life where it hurts to have a really compelling vision or product story: even if it doesn’t stoke new competition, they might at the very least waste your time—something startups can’t afford.

The makings of a successful referral program

Referrals are much easier to implement than partnerships. The only structure that must be in place are these:

Clear Value Proposition - the easier it is to recite, the better.

Incentives - money, like-kind services, prizes, or anything else that convinces someone it’s worth the effort to refer business.

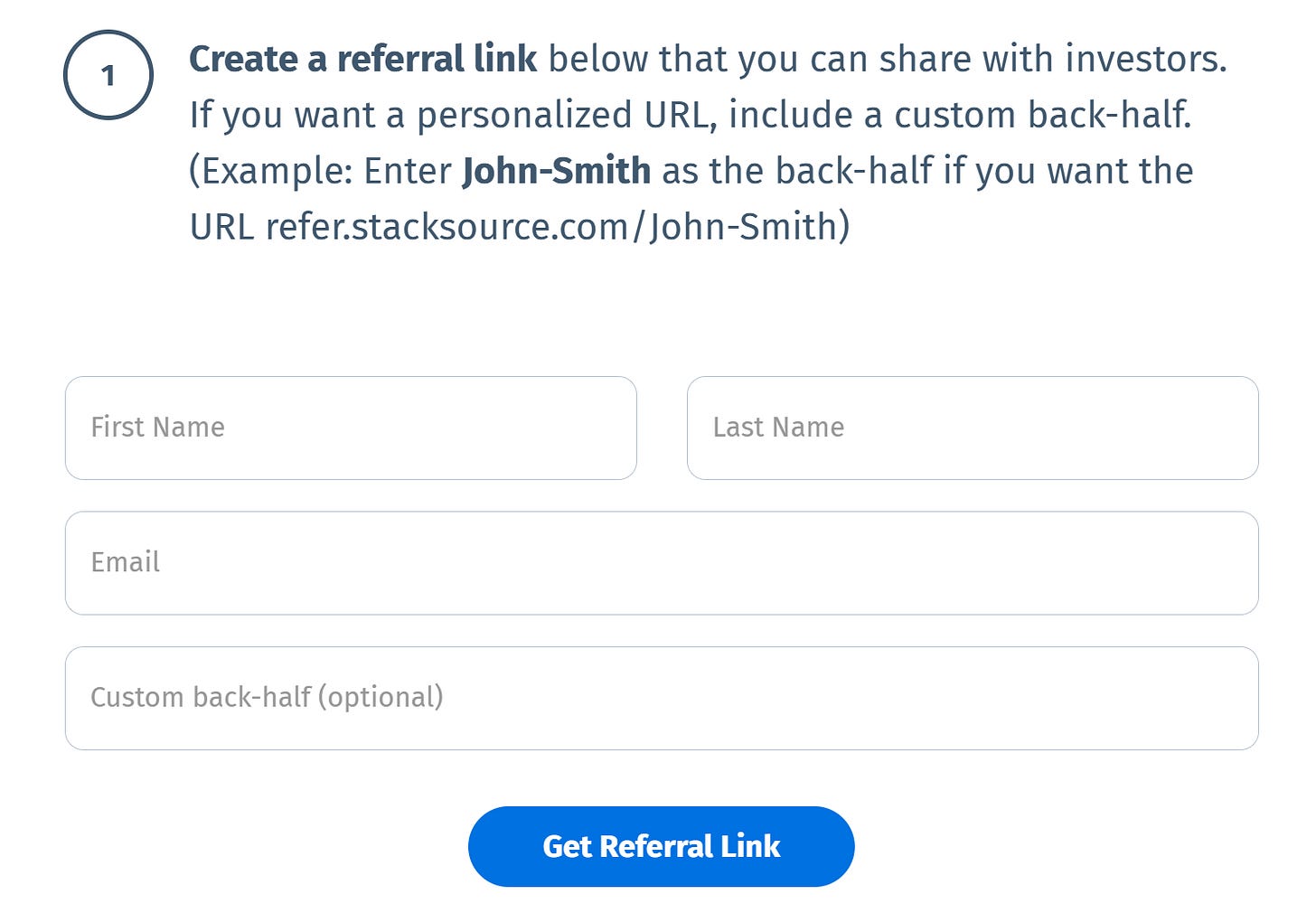

Our referral channel at my proptech startup was one of the key reasons we grew as fast as we did. Our incentive was simple: a percentage of realized revenue upon a closed transaction. We also put in some technical work to make it easy to generate a custom referral link, which would track clicks and automatically tag referral sources in our CRM, so anyone could become a referral partner and share the word around.

By keeping the referral channel uncapped and making it lucrative to the point of impacting our own margins (more on that in another story), we had both a high number of referral attempts, as well as some very successful ones. Our top referral partners earned six figures in cash. The business coming in through this channel totaled seven figures and gave a real boost to our growth rate.

I loved this channel because it didn’t take any upfront or ongoing direct marketing spend. We attracted referral partners organically with our content, and if they converted, we only made payments when we got paid.

Referral programs can be simple, but they don’t grow themselves. Like any channel, they require active management and engagement. However, unlike partnerships, they don’t require nearly as much upfront effort or strategic alignment—making them a far better bet for early-stage startups.

While partnerships often fail, referral programs can be a reliable and scalable growth channel. Many founders (myself included) get distracted by the allure of big strategic deals, but in reality, simply incentivizing people to share your product can drive far more immediate results. If you’re an early-stage startup, put your energy into referrals before you chase partnerships.